You can see the bulk of the EMI payments during the initial years goes towards interest payment. If you have a home loan, just ask your lender for the home loan amortization table. It will indicate exactly your outstanding home loan amount at any point in time. Or you can easily get a quick idea of the same using online loan amortization table calculators.

Axis Bank does not undertake any liability or responsibility to update any data. No claim (whether in contract, tort or otherwise) shall arise out of or in connection with the services against Axis Bank. In case, you don’t want complex calculator and would like to just calculate the relation between EMI and Interest rate.

As name suggest, it is capable to handle different types of loans. For example, one of the leading housing finance company provides home loan at fixed interest rate for first two years. Currently, after two years the interest rate increases to 11.5% – 12% after a shift from fixed to floating. Now they offer to reduce the interest rate to 10.20% on payment of conversion fees. In such scenarios, it is beneficial to balance transfer or shift home loan to bank/HFC offering lowest interest rate. When the interest rates are on a downward slope then old/existing borrowers are locked at higher interest rate.

By making Home Loan Prepayments you can Save Home Loan Interest since loan prepayments help you to reduce outstanding principal amount remaining. It’s a monthly payment that the borrower makes towards repayment of the home loan. The best part about EMI is that you get to repay back the loan in small parts which are easier for most salaried individuals. If something is unaffordable for you as of now, you can purchase it by taking a loan and repaying back in smaller EMIs over a period of time. It’s pretty simple to create a loan amortisation schedule if you know the loan’s monthly payment.

Loan Amount is calculated as Home Value + Loan Insurance — Down Payment. Cover arranged by Axis Bank for its customers under Digit Illness Group Insurance Policy . Please do not believe any entity using Axis Bank logos & branding to request the public for money in exchange for opening a Customer Service Point. Remember, skipping EMIs does not reflect well on your creditworthiness and could impact your credit score.

Any prepayment goes on to the principal, effectively leaping you ahead on the payment schedule. Make further payments—on typical lengthy-time period mortgage loans, a very huge portion of the earlier payments will go in direction of paying down interest quite than the principal. Any additional funds will decrease the loan steadiness, thereby lowering interest, and allowing the borrower to repay the mortgage earlier in the long term.

SBI HOME LOAN

If you want to calculate for more years, then just select the last row and drag it to extend it. Drag cell no B12, D12 and F12 till amount in column I i.e. “Balance Loan” becomes zero or negative. For example, i entered the loan amount, interest rate and installment amount as 75L, 9.55%, and 1L respectively. In this case, “Balance Loan” becomes negative in 115th Month. For example, a totally amortizing mortgage for 24 months could have 24 equal monthly funds.

To resolve this let’s regulate the N and I parts so they’re both expressed monthly. We can convert the total variety of compounding intervals to 30 x 12, or 360 months and the speed to 4.5% / 12, or 0.375% per month. Stay on prime of a mortgage, house improvement, scholar, or different loans with this Excel amortization schedule. Use it to create an amortization schedule that calculates total curiosity and total payments and consists of the choice to add further payments. This loan amortization schedule in Excel organizes funds by date, displaying the start and ending stability with each cost, in addition to an total mortgage abstract. Download and hold your mortgage amortization data shut at hand.

You can apply for a Home Loan whilst you are working abroad, to plan for your return to India in the future. You can apply at any time once you have decided to purchase or construct a property, even if you have not selected the property or the construction has not commenced. Currently the home loan interest rate in India can range anywhere between 7% – 10% per year. If you get home loan below this range, it’s a good bet for you. You should research and try to find your loan with less interest rate to pay less interest for your home loan. This is the amount you pay every month for the home loan you have taken.

How do I calculate loan repayment schedule in Excel?

- Set up the amortization table. For starters, define the input cells where you will enter the known components of a loan:

- Calculate total payment amount (PMT formula)

- Calculate interest (IPMT formula)

- Find principal (PPMT formula)

- Get the remaining balance.

This printable vehicle service template calculates the year-to-date total automatically for you. The payment schedule will automatically display the scheduled dates of repayments, the beginning balance, total payment, interest & principal payments, & end balance for each period. An amortization schedule is a table with a row for each payment period of an amortized loan. Principal repayments that will cause the unpaid principal balance to be zero at the end of the loan. Loan Amortization is the gradual repayment of a debt over a period of time. In order to amortize a loan, your payments must be large enough to pay not only the interest that has accrued but also to the principal.

Whether you select to pay slightly extra every month or a lump prepayment annually, it is important that you set a aim you will be able to take care of. Biweekly payments are a gorgeous option as a result of the prepayment turns into automated. Let’s say your regular mortgage cost is $1,000, but you pay $1,a hundred each month. After three funds, you will have your principal paid down to the place it might have been after 4 payments should you had made simply the required fee. As mentioned above, you can save home loan interest paid by you by making prepayments. Less Interest rate means you’ll pay less Interest throughout your loan tenure.

Download Our App

Monthly Maintenance Expenses is what you pay to keep your apartment shining, clean and ‘water-full’. If its an independent house, you can assume your annual maintenance expenditure to be about one percent of your home value. Divide this number by 12 to arrive at monthly maintenance amount. Down Payment, aka Margin, is the total money you paid to the seller or builder from your own pocket, entered either in Rupees or as a percentage of Home Value. Say due to insufficient balance or any other reason, assuming EMIs remaining the same, the tenure of the loan would increase.

How to calculate loan repayment schedule?

How to Calculate Amortization of Loans. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12.

Simply key in the amount, rate and tenure for which the personal loan is sought, the Personal Loan EMI Calculator will automatically reflect the EMI’s applicable for the loan tenure. Definition of ‘repayment schedule’ Bank and borrower agree an alternative repayment schedule in remaining cases. Before you go bankrupt, try to negotiate a repayment schedule with your creditors. Also, draw up a repayment schedule so you all know when it’s being settled. Make sure you’ve informed your lender that any extra cost quantity is to be utilized to your principal balance. Otherwise it may be utilized to your subsequent fee, and this will lengthen the lifetime of your loan quite than decrease it.

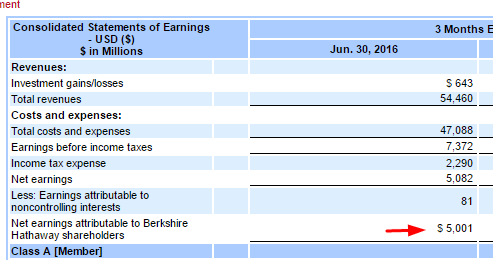

Many people are looking to maximize the tax benefits of home loans. But if you wish to manage your home loans wisely without compromising other goals, do read this detailed post on managing home loans. The calculator will also give you the EMI principal and interest calculator breakup in excel.

Pay

This is why, your principal remaining or outstanding principal amount is deciding factor for the interest amount you’ll pay every month. Reducing this amount gradually as earl as possible , you can reduce the interest amounts substantially. A home loan is probably the biggest loan you will ever take in your life. At least for the vast majority of people who aren’t into business requiring business loans. So you should understand how to calculate EMI on home loan correctly even if you have to use a loan EMI calculator in excel or otherwise.

EMI calculator is very useful decision-making tool for all types of loan. Last but not the least, in the case of prepayment, you should also include home loan tax deduction to check the net benefit. Normally, we only check top level calculation rather taking 360-degree approach. To detail every payment on a loan, you’ll be able to construct a mortgage amortization schedule. To calculate amortization, start by dividing the loan’s interest rate by 12 to search out the month-to-month interest rate.

How do I create a repayment schedule in Excel?

- Create column A labels.

- Enter loan information in column B.

- Calculate payments in cell B4.

- Create column headers inside row seven.

- Fill in the ‘Period’ column.

- Fill in cells B8 to H8.

- Fill in cells B9 to H9.

- Fill out the rest of the schedule using the crosshairs.

Hence, borrow wisely, within your means, in the interest of your financial wellbeing. For further details or to begin availing your loan, simply click on the “Get a call back” button and fill in your details. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans. Please get answers to your common queries regarding the home loan, security, EMIs, etc. Is quite excited in particular about touring Durham Castle and Cathedral.

Lesson#198: How to make a Loan EMI calculator in Excel

Since we need the monthly payment, we need to express the function augment in months. Few lenders let you pay off the EMIs progressively on a long term basis. This indicates repayment schedule in excel that as your salary increases, the loan is paid off faster. Schedules prepared by banks/lenders will also show tax and insurance payments if made by the lender.

- It is very useful through the early years, when even a small quantity of prepayment can transfer you ahead a number of months on the schedule.

- The EMI of any loan is ascertained by the major factors viz.

- But if you wish to manage your home loans wisely without compromising other goals, do read this detailed post on managing home loans.

If you’ve ever looked at a loan payment schedule, you’ll be able to clearly see the benefits of paying additional to the principal in your mortgage. An amortization table or schedule may help you estimate how lengthy you will be paying on your mortgage, how much you’ll pay in principal, and the way much you will pay in curiosity. Making modifications to how large or frequent your payments are can alter the period of time you’re in debt. You have a remaining balance of $350,000 in your current house on a 30-year mounted fee mortgage.

Principal & Interest Amounts

The following EMI Calculator or Amortization Calculator can be used for all types of loan. I tried and tested with Personal Loan, Auto Loan, Consumer Loan, Business Loan etc. The details required and calculation is same for any type of loan. For month two, do the same thing, except start with the remaining principal steadiness from month one rather than the unique amount of the loan. By the end of the set loan term, your principal must be at zero. And this is how you will save bike loan interest amount as this is the only amount which is variable.

At Axis Bank, a personal loan is granted within 48 hours, sometimes even on the same day. Home Loan Balance Transfer calculator allows you to calculate benefit of transferring your home loan from any bank to SBI. As you notice, principal amount is lowest initially and increases with every month after you pay EMIs. On the other hand, interest amount is highest initially and decreases with time after your EMIs are paid every month. EMI refers to the ‘Equated Monthly Installment’ which is the amount you will pay on a specific date each month till the loan is repaid in full.

This is why it is essential to know how to calculate your EMIs well before you borrow, as it helps you plan your repayment effectively. Since it is a mathematical calculation, you can use the EMI formula in excel and output the results manually. This process will require you to also calculate the values for a few variables, so it requires a level of proficiency. Amortization refers back to the reduction of a debt over time by paying the same quantity each period, often month-to-month.

Does Microsoft Excel have an amortization schedule?

Does Excel have a loan amortization schedule? Yes, Excel has a simple loan amortization schedule template available.

Comentarios recientes